Recently, we have received an investor's exposure to the TMGM foreign exchange platform, saying that abnormal transactions are questioned: 2700.51 low -priced buying empty single 6000U instant loss!Intersection

Today, let's take a look at what is going on?Intersection

After continuing to understand the situation of the investor, we learned that he did not have a satisfactory response to the TMGM foreign exchange platform.

Investors said that he has repeatedly contacted the platform customer service, but the answers obtained failed to explain why the unusual low price of 2700.51 occurred, and why it caused instant loss of 6000U.

Investors emphasized that he was not dissatisfied with the normal fluctuations in the trading market, but expressed doubts about the errors or improper behaviors that the platform may occur during the transaction execution process.

He pointed out that there was no obvious price fluctuation at the market at that time, and the stop loss price he set was much higher than the actual buying price, so it was difficult for him to understand why such a big loss occurred suddenly?Intersection

In order to prove his statement, investors also provide evidence such as transaction screenshots and account transaction records.

It can be seen from the screenshot that it did buy a single order at a price of 2700.51 at 03:30 on December 12, 2024, and immediately caused a loss of 6000U.

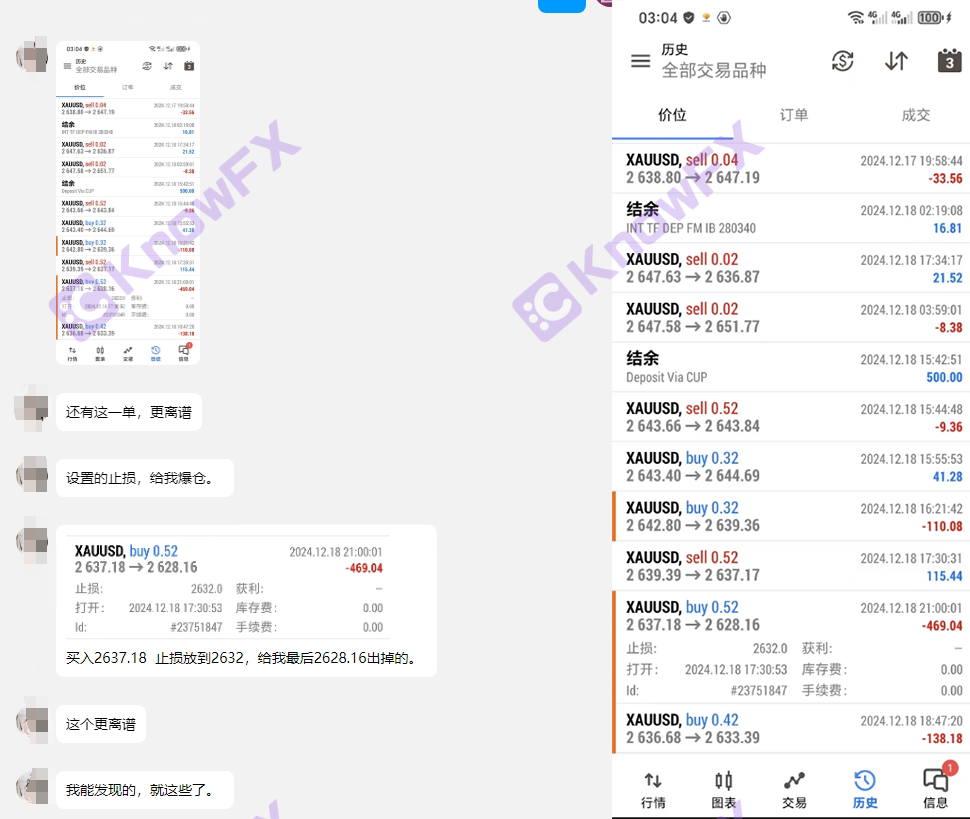

In the end, a order is more outrageous, which is reflected in the TMGM platform transaction that the stop loss execution does not meet the expected problems.

Investors bought the gold price of 2637.18 and set up the stop loss point to 2632, but the price at 2628.16 was finally lined, causing accidental losses.

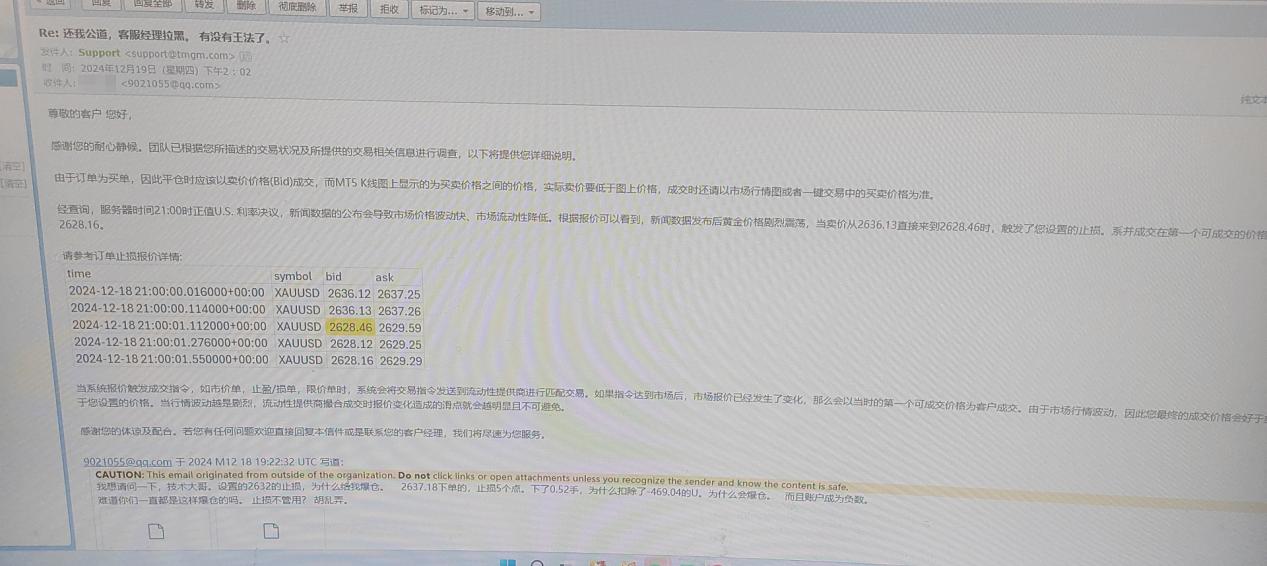

The platform's response to this is that because the order is paid, it should be sold at the selling price (BID) when liquidating, and the intermediate price displayed between the MT5 software is the actual selling price below the price.In addition, the platform also pointed out that at that time, the US interest rate resolution was announced that the release of news data caused the market price to fluctuate violently, and the market liquidity decreased, which triggered stop loss.

For this incident, we need to analyze from multiple angles.

First, the implementation of stop loss.

Investors set the stop loss point before the transaction, which is a protection measure to limit potential losses.However, in actual operation, the implementation of stop loss is often affected by many factors, including market price fluctuations, market liquidity, and platform transaction execution mechanisms.Therefore, when setting up stop loss, investors need to fully understand the impact of these factors on the implementation of the stop loss.

Secondly, the rationality of the platform response.

The platform pointed out that because the order is paid, it should be sold at the price when closing the position, which is in line with the trading rules.At the same time, the platform also explains the difference between the price displayed on the MT5 software and the actual transaction price.In addition, the platform also mentioned the impact of news data release on market price fluctuations and market liquidity.These factors are possible causes of stop loss.

However, this does not mean that the platform can completely shirk responsibility.When providing transaction services, the platform is responsible for ensuring the fairness and accuracy of the transaction execution, and minimizing the loss caused by market volatility and liquidity issues as much as possible.

In addition, the "Sao" operation of the TMGM platform has no lower limit, which has caused widespread discussion on the Internet.These discussions are not only focusing on the platform's problems in transaction execution, customer service and other aspects.

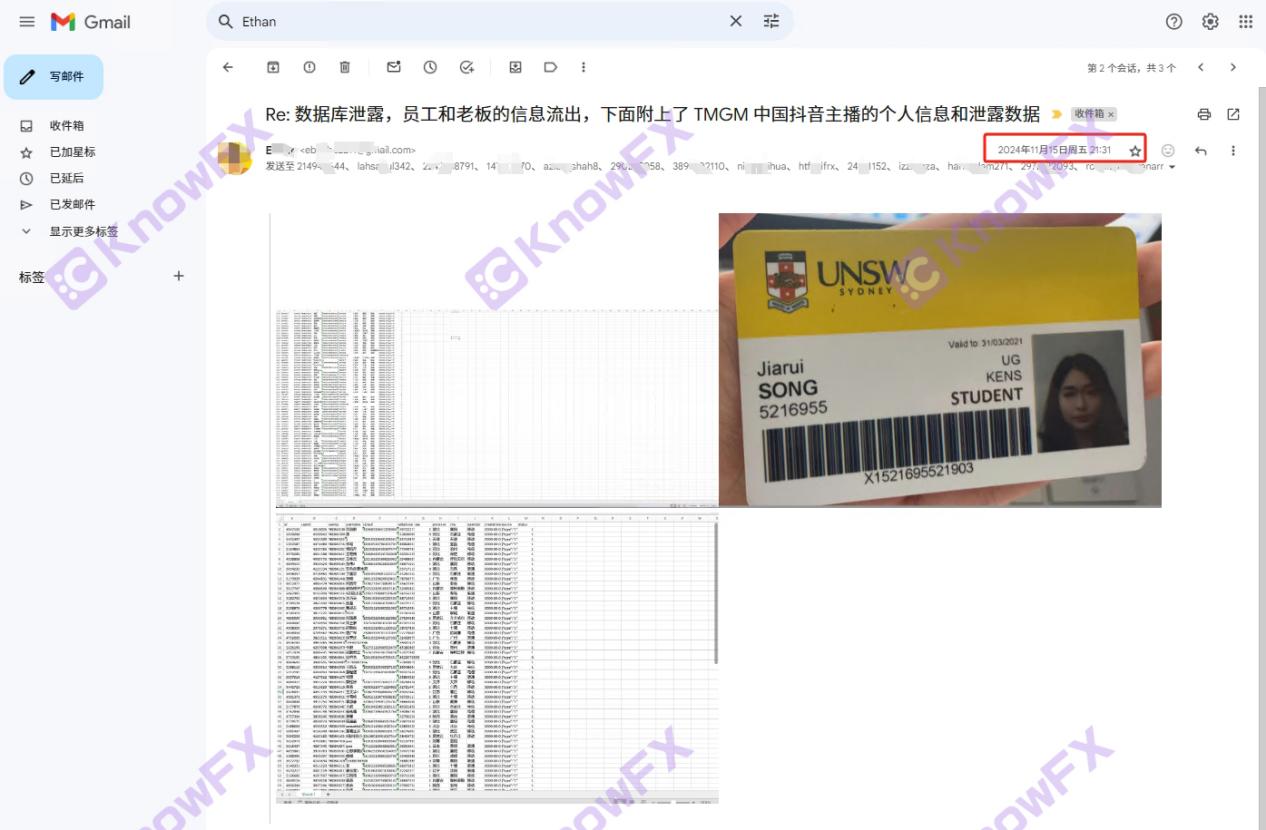

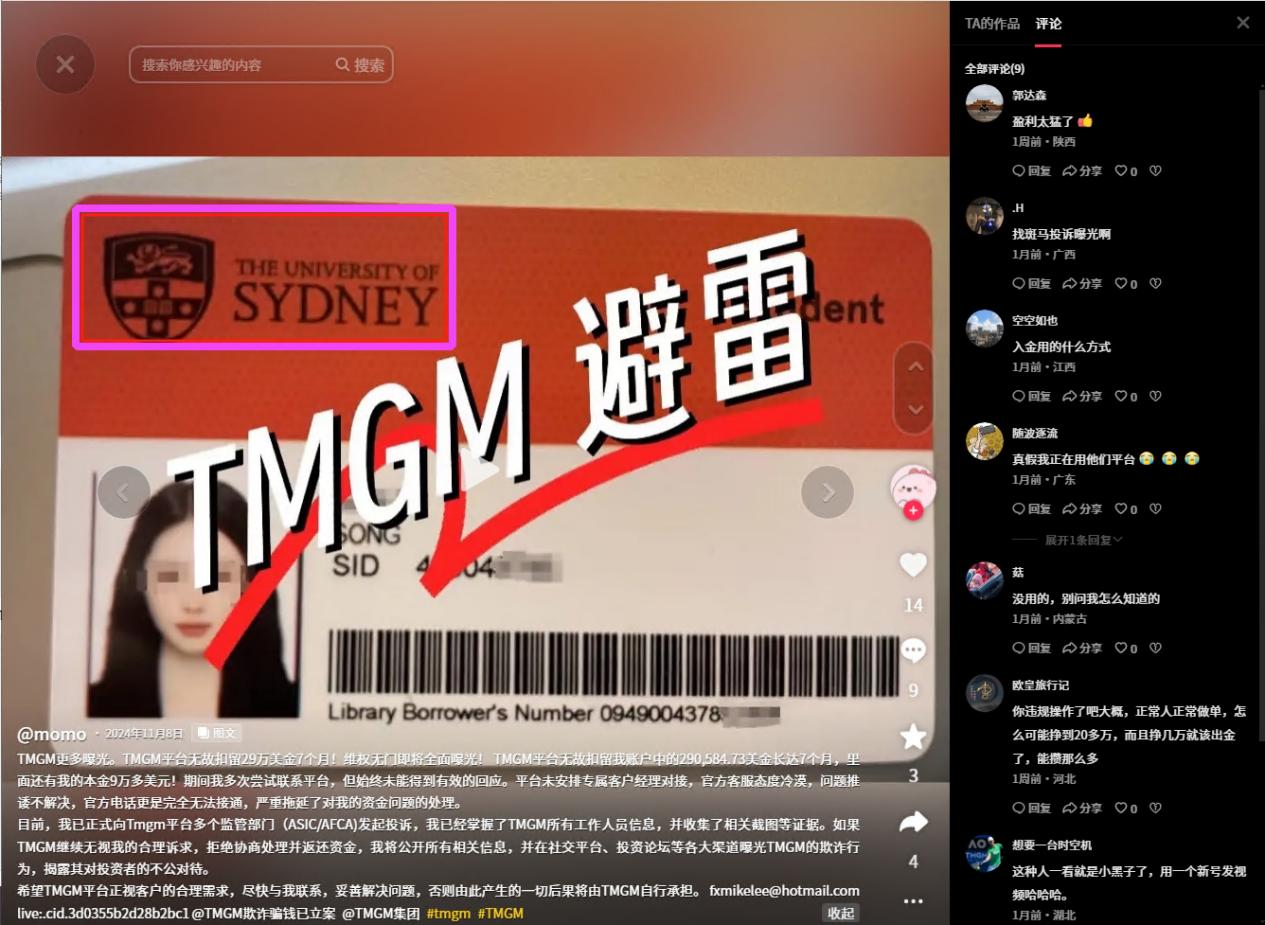

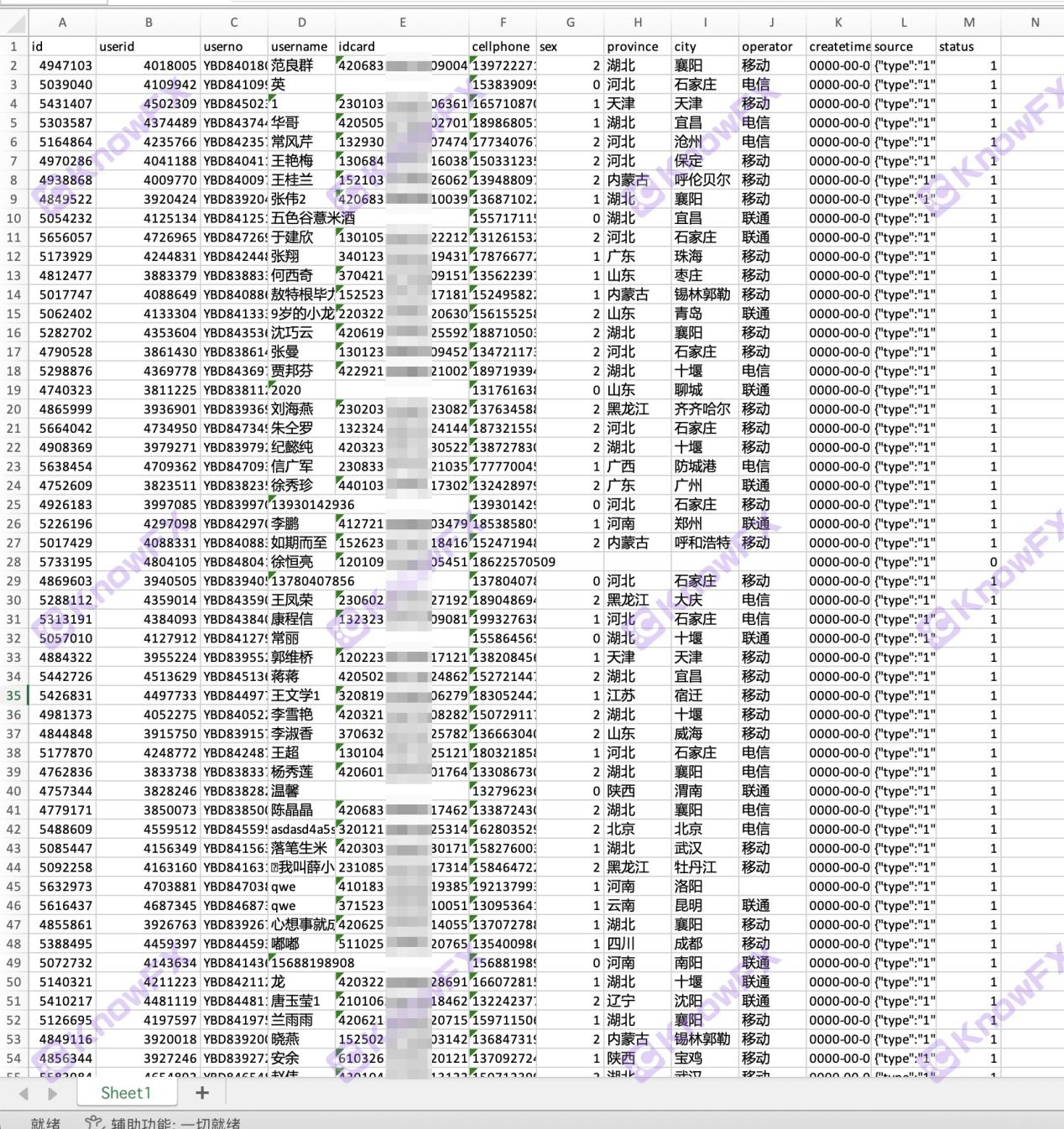

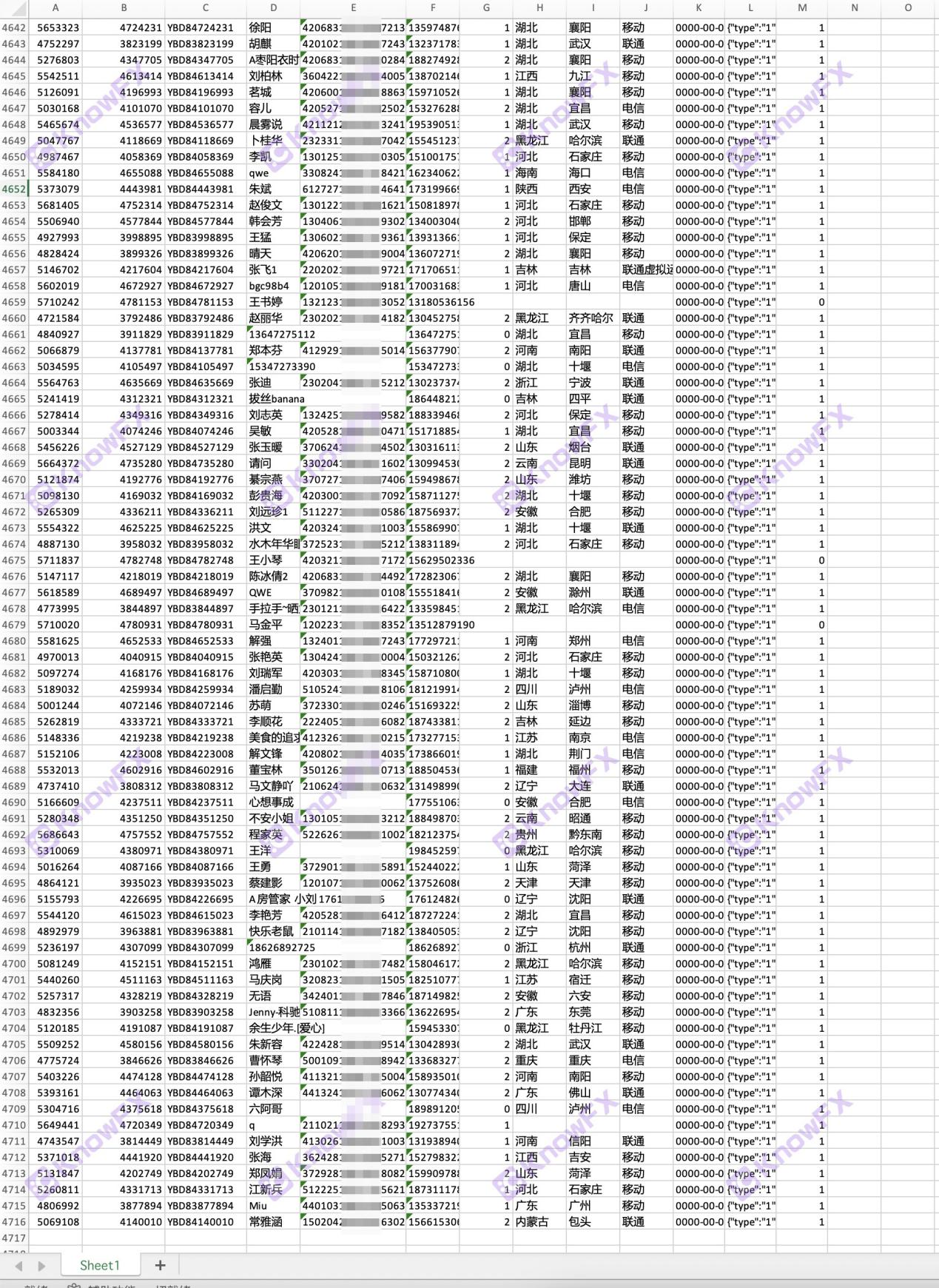

Just in November last year, we received an email involving the personal information and leak data involving TMGM China Douyin anchors.

Compared with the screenshot evidence exposed by investors on Douyin, it can be clearly seen that the business card logo design in the mail is highly similar to the anchor information on Douyin, and may even be the same group of people.

What is even more shocking is that the people on the list are all in the country, which further exacerbates investors' concerns about the security of the platform's data.

Then according to the feedback from Hui friends, there are unfair behaviors during the implementation of the stop loss, and may even deliberately set up obstacles to lead to investors 'losses and the platform lacks timely and effective in customer service. For investors' complaints and complaints andQuestions are often perfunctory and failed to give a satisfactory reply.

Faced with these accusations and doubts, the TMGM platform should take positive measures to respond and improve.

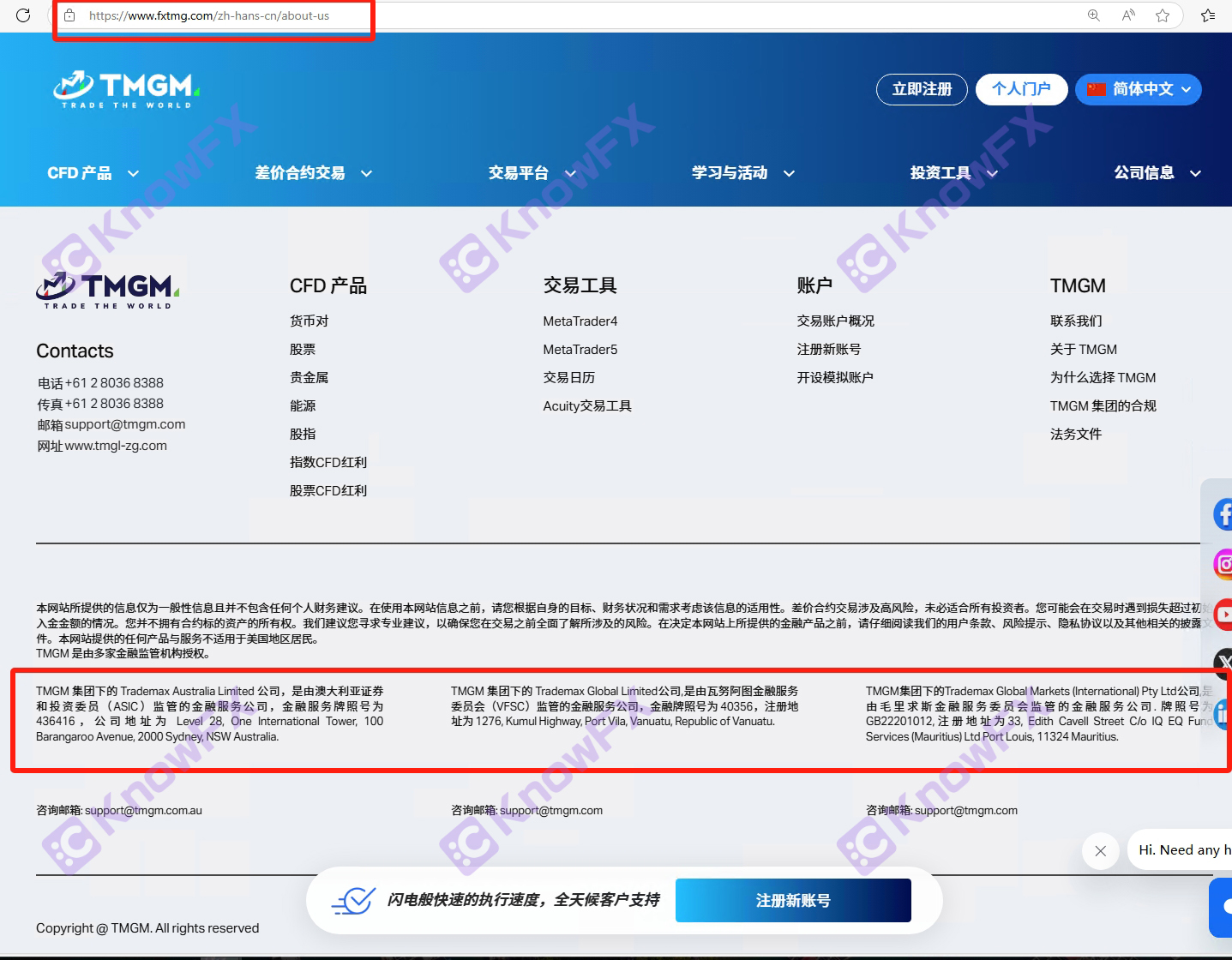

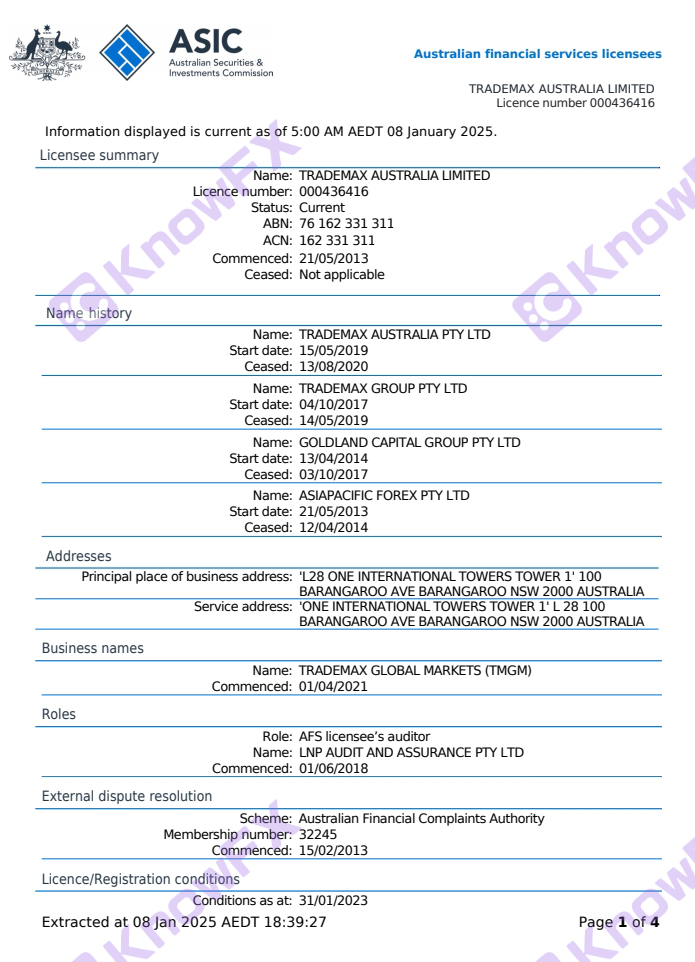

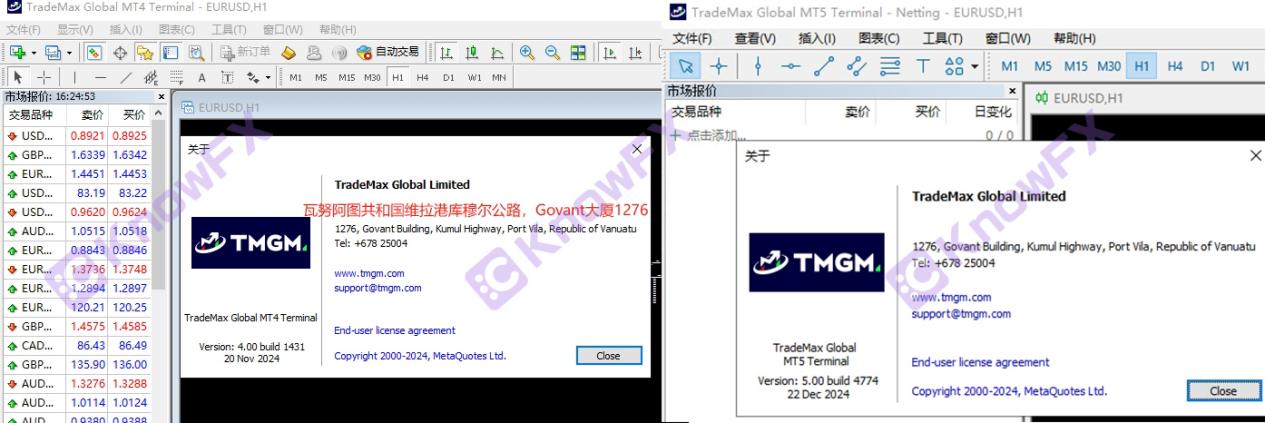

Finally, let's gather the focus to the domestic website of TMGM. Although TMGM mentioned the three companies in the supervision of financial institutions introduced by the official website, the servers currently used in MT4/5 trading software are mainly related to the two companies of Australia and Vanuatu.Essence

However, Australia ASIC has clearly stated that customers who no longer accept the Chinese market.This means that although Trademaxaustralialimited is regulated by ASIC, investors in China cannot be traded directly through the company's supervision.

It is worth noting that TMGM still expands its business in the Chinese market and uses the Australian regulatory platform as a publicity point.This may be because TMGM provides services for investors in China through other methods (such as offshore companies, etc.).

Specifically, TMGM customers are likely to be traded through the accounts opened by the island company under the Wanuatu regulatory by TrademaxglobalImited in China. This can also prove this through the screenshot of the account information provided by Huiyou!Intersection